↧

CHQ writes to Member (T) on CSI issues

↧

Financial Inclusion Will Be Marketed By India Post Payments Bank

Manoj Sinha, the Communications Minister, this week claimed that the government is operating on setting up 650 outlets for India Post Payments Bank to make easy the financial enclosure, and revealed 2 new schemes by the postal division.

“We will be opening almost 650 outlets for India Post Payments Bank all over India. Two, namely in Ranchi and Raipur, have already commenced. The goal is that via 650 banks for post payments, we can force financial enclosure in 1.55 Lakh rural areas,” Sinha claimed to the media.

Sinha urged the postal workers to carry on reorienting themselves with disruptions and technological changes in order to drive innovative schemes to users, all the while keeping the communal values.

“Given the disruptions and with the approach technology is changing, it is fine to connect yourself with tech but values of department too have to be preserved, and that is the largest defy,” he claimed pointing out the long past of postal services in India, specifically the importance of the postman in rural area of the country.

The minister who was talking at an occasion to memorialize National Postal Week also declared 2 new schemes namely e-IPO (Indian Postal Order) and International Tracked Packet Service. The e-IPO was rolled out in denominations of Rs 50, Rs 20, and Rs 100 and now can be employed for educational institutions for fee payment and other causes. Previously, e-IPO of Rs 10 might be utilized only for RTI purposes.

The e-IPO has been launched out as a lead project in Delhi, Bihar, and Karnataka and is anticipated to be rolled out in the whole nation in the upcoming 2 Months. “Users can obtain e-IPO online from workplace or home of their own, as per their convenience. This roll out is a fraction of Digital India proposal since the transaction will be made via credit card, debit card, and net banking,” claimed Department of Post to the media in a statement.

The minister claimed that the postal department of India has undergone a huge change over the time, be it core banking, inter-operability of ATMs, or Aadhaar enrolment and providing of Passport Seva.

Source : http://columnistnews.com/

↧

↧

C S I Reference Book

↧

C S I Ready-Recknor

↧

C S I Hand Book

↧

↧

EDITORIAL POSTAL CRUSADER NOVEMBER-2017

EXISTENCE OF POSTAL DEPARTMENT AND

POSTAL EMPLOYEES

UNDER ATTACK

WE HAVE TO RESIST IT AT ANY COST.

Government has unleashed an unexpected and most damaging attack on Post Office Small Savings Schemes. Notifications are already issued permitting all Nationalised Banks and three Private Banks (ICICI Bank, Axis Bank and HDFC Bank) to accept deposits for all small savings schemes, viz: Recurring Deposit (RD), Time Deposits (TD), Monthly Income Scheme (MIS), Senior Citizens Savings Scheme (SCSS) Sukanya ‘Samridhi Account (SSN), Kisan Vikas Patra (KVPs) and National Savings Certificate (NSC VIII issue) with effect from 10th October, 2017.

Small Savings Schemes are controlled by Finance Ministry and Postal Department is running it on agency basis. Finance Ministry is paying compensation to Department of Posts for various Small Savings Schemes related work. About 40% of the total yearly revenue of the Department of Posts comes from Small Savings Schemes. Permitting Banks including private banks to do small savings business means huge erosion in the revenue of Postal department. Even otherwise Postal department is running on heavy loss and the decision to outsource small savings business will further aggravate the deficit situation.

Out of total work load of the Post offices 50% workload relates to Savings Scheme work. In some Post offices even 70% of the work load relates to Savings Bank Branch. Not only the public directly coming to the Post Office counter for deposits and withdrawls, lakhs of MPKBY Agents and SAS Agents also canvas for various small savings schemes and contribute to the revenue and work load of Post Offices. Once the banks including private banks starts the Small Savings Business aggressively, the number of transactions in Post Offices will come down. This will result in reduction in the sanctioned posts for SB work and ultimately staff, especially clerical staff will become surplus.

Few years back, a committee appointed by Reserve Bank of India to study the functioning of Post office Small Savings Scheme, headed by Ms. Shymala Gopinath, then Deputy Governor, Reserve Bank, has recommended gradual phasing out of MPKBY/SAS Agents. The Committee has recommended to reduce the Commission paid to the Agents by 1% every year till it reaches 1% level from the present 4% commission. The commission to SAS Agents are also reduced. Due to the struggle and intervention of MPKBY/SAS Agents Associations and lefet parties Members of Parliament the commission is retained at 4% for MPKBY Agents. The present decision of the Government to outsource Small Savings Schemes to Banks will definitely affect the job security of MPKBY/SAS Agents also.

Wage revision orders of Central Govt. employees were issued on 25-07-2016. The demands raised by staff side to raise minimum pay and fitment formula is not yet considered favourably, even though Group of Ministers had given categorical assurance on 30-06-2016. Consequent on appointment of 7th Pay Commission, Government appointed a one man committee headed by Sri. Kamalesh Chandra, Retired Member (Personnel), Postal Services Board on 19-11-2015 to examine the wages and service conditions of about three lakhs Gramin Dak Sevaks working in the Postal Department. The Committee submitted its report to Government on 24-11-2016. Almost one year is over but the favourable recommendations of the GDS Committee are yet to be implemented. The file was sent to finance Ministry by Postal Board after approval of the Communications Minister. Queries after queries are being raised by Finance Ministry and the file is still pending clearance. 7th Central Pay Commission Report was submitted on19-11-2015 and it took eight months for implementation of pay revision. Seventh CPC report was in respect of more than one crore (100 lakhs) personnel including 32 lakhs Central Govt. employees, 33 lakhs Civilian pensioners and about 40 lakhs military personnel and pensioners. Regarding GDS, there are only about three lakhs employees. One year delay for implementation is quite unjustified and it shows the attitude of the Government to the most downtrodden section of employees.

Re-verification of membership under check off system was conducted for regular employees as per the CCS (RSA) Rules in the year 2015. Now two years are over, but result of the verification is withheld by the Government for reasons best known to it. GDS Membership Re-verification process was almost completed and recovery of subscription from pay in respect of Applicant Association/Unions commenced in the month of September 2017. Suddenly Department issued orders to stop the GDS Membership verification process. It is learnt that BPEDEU (BMS) which represents only 3 to 5% membership and not going to get recognition has filed a complaint and based on the complaint the GDS verification process was stopped by the Government.

The above happenings are not isolated. It is a prelude to bigger attacks that is going to come in the coming days. The job security of Postal employees, their wages and trade union rights are under attack. We have to resist it at any cost, just like we have resisted and defeated Govt’s move to amend Indian Post Office Act, Closure of 9797 Post offices, closure of 300 RMS offices, Mckinsey Consultancy’s recommendations and the TSR Subramanian Committee’s recommendations, for corporatisation and privatisation of Postal department.

NFPE has already given a call for countrywide demonstrations at all centres and infront of all offices on 23rd October, 2017.

Further, major demands raised in our 23rd August, 2017 strike charters of demands are also pending settlement. NFPE Federal Secretariat shall meet shortly and declare further agitational programmes.

NFPE and all its affiliated Unions/Associations calls upon the entirety of Postal and RMS employees including Gramin Dak Sevaks and Casual, Part-time Contingent employees to unitedly resist and defeat this onslaught on our life and livelihood.

↧

Vigilance Awareness Week : Integrity Pledge on 01.11.2017 by the staff members of Ashoknagar MDG

↧

Notice for holding an Extraordinary General Body Meeting of AIPEU, Group-C, Bhubaneswar Division on 05.11.2017 (Sunday) in Janla Panchayat Office, NH Side, Opposite to Janla SO, Khurda.

Dear Comrades

This has a reference to our Divisional Union Notice dated 30.10.2017. The venue of the General Body Meeting has been changed to Janla Panchayat Office NH Side, Opposite to Janla SO, Khurda.

Therefore all the comrades are sincerely requested to arrive by 9.30 AM on 05.11.2017 for timely conductance of the meeting.

The revised Notice is reproduced below for reference.

N O T I C E

No. UN / BN – AIPEU /Gr.-C / 02-10 / 2017

Dated at Bhubaneswar the 30th October, 2017

Notice is hereby given under Article 48 of the Constitution of All India Postal Employees Union, Group–C to hold an Extraordinary General Body Meeting of AIPEU, Group-C, Bhubaneswar Division at 10.00 AM on 05.11.2017 (Sunday) in Janla Panchayat Office, NH Side, Opposite to Janla SO, Khurda.

The following shall be the agenda for discussion.

1. Organizational Issue:

i. Review of one day strike on 16.03.2017 and 23.08.2017

ii. Review of Implementation of Confederation / NFPE agitational programmes

iii. March to Parliament on 11.11.2017

2. Implementation of Cadre Restructuring proposal in Odisha Circle and issues relating to Bhubaneswar Division.

3. Reorganization of Postal Divisions and position of Bhubaneswar Division

4. Proposed rollout of RICT and CSI

5. Local Issues:

a. Engagement of Outsourced Postal Agents(OPAs)

b. Irregular attachment of P A as SPM of LSG SO and compulsory deduction of HRA.

c. Problems of women employees – Posting in offices without basic amenities.

d. Irregular / arbitrary orders of deputation

e. Problems of dequarterization.

f. Irregular Holding of Monthly Union Meeting and improper attention / non-disposal to/of union representations.

g. Provision of Police Escort in Cash Van & Deployment of Arm Guards in BBSR GPO

h. Case of Joint Custody of cash, stamps and valuables in Bhubaneswar GPO

6. Specific general problems of individual Post Offices.

7. Role and responsibility of the Divisional Union towards AIPEU GDS (NFPE) and Casual Workers.

8. Financial Review.

9. Filling up of vacancies of the office bearers created due to reorganization of postal Division in accordance with the provisions under Clause 47 of the Constitution of AIPEU, Group-C.

10. To pass resolutions on the problems of the employees and devise ways and means to implement the policies and directives of Confederation / NFPE / CHQ / Circle Union.

11. Any other item(s) with the permission of Chair.

12. Vote of thanks.

(D R MOHANTY)

Divisional Secretary

Copy to:

1. The President, AIPEU, Gr–C, BBSR Divn. & APM, Bhubaneswar GPO.

2. Com. B Samal, Circle Secretary, AIPEU, Group-C, Odisha Circle branch. He is requested to attend the meeting.

3. The Senior Superintendent of Post Offices, Bhubaneswar Division, Bhubaneswar – 751 009.

4. All elected Office Bearers and Members.

5. The Chair-Person / Convener / Sub-Convener / Members of the Women Sub-Committee.

6. Notice Board.

(D R MOHANTY)

Divisional Secretary

↧

Govt employees can monitor sexual harassment complaints online

Women employees working in government departments can now lodge complaints of sexual harassment at work place online and can monitor action being taken on them too.

The Department of Personnel and Training (DoPT) has recently written to all central government departments asking them to inform the women employees about many such features of Sexual Harassment electronic-Box or SHe-Box -- launched by the Ministry of Women and Child Development on July 24.

“Once a complaint is submitted to the SHe-Box, it will be directly sent to the Internal Complaints Committee (ICC) of the concerned ministry, department, public sector undertakings, autonomous body, etc., having jurisdiction to inquire into the complaints,” the DoPT said in a missive.

The SHe-Box also provides an opportunity to both the complainant and nodal administrative authority to monitor the progress of inquiry conducted by the ICCs, it said.

Any woman working or visiting any office of central government can file complaint related to sexual harassment at work place through this SHe-Box, the DoPT order issued yesterday said.

The status of complaints can be viewed at any time by pressing the tab ‘View Status of Your Complaints’ within SHe- Box, it said, asking all the government organisations to inform all employees working under them about the various features of the SHe-Box.

The SHe-Box portal can be accessed at www.shebox.nic.in/.

Source : http://www.hindustantimes.com/

↧

↧

RBI employees stage protests on pension issue

Reserve Bank of India (RBI) employees and officers, including retirees, held rallies in all offices of the central bank on Thursday, demanding pensions be updated and a fresh option to join the pension scheme in lieu of the contributory provident fund (CPF) scheme.

The pension of retired employees of the central bank continues to get 50 per cent of the last pay drawn, whereas the pension for central government employees get periodically revised with every pay commission-recommended wage revision, said a statement from the All India Reserve Bank Employees Association.

The central board of the RBI has been trying for the past few years to update the pension drawn by the retirees in line with central government employees, but the government remains non-committal. The RBI governors, both Urjit Patel now and Raghuram Rajan before him, assured the government that the cost will be borne by the central bank itself, without burdening the exchequer, but the government hasn’t given its nod. Recently, Patel had written to the government to introduce the pension scheme option.

The RBI introduced the pension scheme for its employees joining after November 1990 and gave an option to existing employees to choose between the pension scheme and CPF scheme. The government then put an embargo from 2002 onwards on the RBI offering its remaining employees to switch over to the pension scheme from the CPF scheme.

However, in the first week of August, the Parliamentary Committee on Subordinate Legislation recommended that the RBI be given the nod to introduce the options to its employees to switch over to the pension scheme, “terming government fiat as arbitrary and not backed by statute,” said the statement.

The RBI central board met at Ahmedabad on Thursday where the RBI unions urged to take up the issue with the government on an urgent basis.

Source : http://www.business-standard.com

↧

Circle Union writes to the Chief PMG / CHQ on problems arising out of CSI roll out in Odisha Circle

No. P3NFPE – Odisha / 01 – 11 / 2017

Dated at Bhubaneswar the 2nd November, 2017

To

Dr. S K Kamila, IPoS

Chief Postmaster General, Odisha Circle

Bhubaneswar – 751 001

Sub: - Problems arising out of CSI rollout – Case of Odisha Circle

Respected Sir,

Inviting a kind reference to this Union’s letter No. P3NFPE – Odisha / 03 – 10 / 2017, dated 10.10.2017 (wrongly typed as 04.10.2017)sent through eMail on 10.10.2017, this is to intimate that experiencing the concern of our staff members of Cuttack City Division on CSI rollout and realizing the genuine issues confronted by them, this Circle Union conducted a Special Working Committee Meeting on 29.10.2017 here in Bhubaneswar.

We collected several information based on theoretical aspects from our Trainers and S As and real problems practically faced by our staff members now working under CSI environment and thus could be able to summarize the following additional operational issues after CSI rollout apart from Training, Hardware and Connectivity issues which have already been brought to your kind notice.

A list of the issues is attached here with for kind reference. However, these are not exhaustive.

As such, we would like to request you to kindly arrange for definite solution of the issues at an early date and till then, it is requested to kindly defer further rollout of POs to CSI.

Expecting your kind response Sir.

With regards.

Yours faithfully,

Attached : As above

(B SAMAL)

Circle Secretary

Copy to Com. R N Parashar, General Secretary, AIPEU, Group-C, CHQ, Dada Ghosh Bhawan, New Delhi – 110 008. The Training, Hardware and Connectivity issues already raised by Tamilnadu Circle are quite familiar with that of Odisha Circle. Here we have pointed out some operational issues under CSI environment apart from the above issues. The Postal Directorate needs to be appraised of these issues in continuation of CHQ letter No. P/4-5/CSI, dated 28.10.2017. This has a reference to this Circle Union letter No. P3NFPE – Odisha / 15 – 10 / 2017, dated 27.10.2017

List of Problems arising out of CSI Rollout in Odisha Circle

Current Issues | Brief of the Issues | Suggested Solution | |

1 | Server Slowness | The systems are found to be running very slow than required due to low Bandwidth, absence of antivirus, pirated software, low signal strength etc. | This is to be solved by the Vendor only increasing the present bandwidth, uploading Anti-virus and checking the availability of signal strength if dongle is used and likewise. |

2 | Non-fetching of PLI / RPLI figures to Treasury | This is said that user mismatch of McCamish and CSI. Even in user-matched cases also, the problem is continuing. There is a provision for temporary solution with regard to legacy adjustments at POS. For, one or two occasions, the legacy adjustment is ok. But the operation of Legacy adjustments regularly for daily PLI / RPLI collections is not correct. This is inconvenient both to the PLI customers as well as to the staff members and may lead to fraud also. For mismatching of McCamish figures in some Post offices the figures are not reflected to POS and thus The TCB figures do not match with that of the Daily Account. | Alternate method to legacy adjustment needs to be developed by the Vendor and action may be taken for proper fetching of McCamish figures. |

3 | Jumping of POS figures | The POS (Point of Sale) figures are Jumping (plus and minus) due to net work issues resulting wrong figures in TCB which is now being solved by using Transaction Code ‘F-02’. Case(i) : If POS balance is taken wrong by system as double entry or more etc. This has to be adjusted using T-Code F-02. Document Type : SK 40 (Debit Entry): DOP 486710010 50 (Credit Entry) : POS 486710011 Case(ii): If POS balance is less T code: F-02 Doc: type :SK 40 POS 486710011 50 DOP 486710010 | The process needs to be simplified to avoid jumping. |

4 | Invalid license in POS | Licenses are registered according the number of systems available in an office. But as it is experienced, the POS and Back Office are not opening giving error message even if licenses are equivalent to the number of systems available. Presently our SAs are solving the above issue using command : C:\ Postal POS_BO run licsvc.bat. | This has to be permanently solved by TCS. |

5 | Mismatch in Opening/Closing Balance | This is being done temporarily by our SAs as explained in the Remark Column under Para – 3 above | This has to be permanently solved by TCS. |

6 | Difficulty is registering Bulk-Mailers | The procedure now available in the present software for registration of bulk mailers, pre-paid bulk booking with bulk booking option and allotment of Regn. No. is not familiar to staff. | The software needs to be simplified |

7 | Acknowledgement Check-up | At the POS Counter, the present software has made Acknowledgement Check-up system mandatory for each and every Regd. letter to be booked which is not all required. This is increasing the transaction time unnecessarily. | It has to be modified with option to undertake wherever necessary to reduce the transaction time for rendering prompt service. |

8 | Absence of separate branch for each category of article | There is no separate branch for each category of article like Regd, Speed, Parcel etc. Only Batch-1 , Batch-2 etc. are developed by TCS. But in post offices there is a branch for every service / product, viz. Regd, Speed, Parcel. When articles are invoiced in Batch 1, all articles irrespective of category are to be taken in the batch which may create problem at the time of taking Postman returns. . Due to such single batch invoicing system, a single user working in a particular batch in DPMS may invoice RL,SP, RP coming to all users under same batch for which all items can be printed in a consolidated manner or can be printed separately for RL, SP, RP etc. i.e one user data is accessible to other to take return (or) modify. Illustratively, the user working for Regn. Only can also take the return for Speed Post and Parcels without the knowledge of the user performing Speed Post and Parcel separately which may give wrong message in delivery /return and the respective abstracts will certainly mismatch. Rather than BATCH, USER BASED data access is required. i.e other user cannot access one users entries. (those who invoice is responsible to take returns also) This is not fit to the present scenario of branches operated by separate users in Post Offices. | Batch Number needs to be identified / created with each particular job, e.g, separately for each category of article for smooth Invoicing and Return. |

9 | Delivery to Bulk-Mailers | The present software has no provision for delivering to bulk-mailers under DPMS. This provision is highly required since staff members are facing problem while delivering articles to bulk mailers. | A provision is to be developed in the present software. |

10 | No provision for Customs Duty | The present software has no provision for receiving Customs Duty from letter or parcel or from ordinary mail in cash which is required under Treasury like Miscellaneous receipts head. Even if it is received somehow, such amount is not reflected in TCB resulting mismatch of cash amount. | It needs to be created / developed in the software and mismatch of data flow problem should be rectified |

11 | Problems for mis-sent and Returned articles | The present procedure available for flow from SAP to POS back office in case of returned and mis-sent articles is inconvenient to staff since the present procedure is compelling to close more bags instead of closing a single bag in DPMS. | The software needs to be modified to the convenience of the staff. |

12 | Problems in printing the TCB | T-code ‘Zfbl3n’ is not compatible for taking printout of TCB. | The Vendor needs to make the same compatible to ease printing out of TCB. |

13 | Rebooking of VPMO | There is no provision in the present software for rebooking of VPMO after delivery which confuses the staff members. | A clarification is required if the VPMO rebooking is necessary or the Z-vpmo upload is enough. |

14 | Cancellation provision for eMO booked / VPMO rebooked | There is no provision for cancellation in the present software except correction of entries. | The software needs to carry a provision in this regard. |

15 | Submission of Transaction Reports | In the present system, the Transaction Reports for eMOs booking, telephone bills acceptance, eMO paid etc are regularly sent to HO for records and verification along with the Daily Account. Staff members are confused if the same are required to be sent to HO since the transactions are now made online. | A clarification may be circulated in this regard. |

16 | Provision of UCR | There is no provision for UCR in the present software where as this head is barely necessary for crediting excess cash found in the counter, sale of old records, crediting renewal fees for Registered Newspapers, Pledge / Release fee for Cash Certificates and such other items. | A head may be developed in the present software or suitable clarification may be circulated how to accept such receipts. |

17 | Provision for UCP | There is no provision for UCP in the present software where as this head is barely necessary for refund of tender fee, EMD, erroneous/excess receipts from customers etc. | A head may be developed in the present software or suitable clarification may be circulated how to refund such payments. |

18 | Incorrect SSL | As experienced, the S S L (Staff Scheduling System) of all the employees are not correctly attached to their offices which is creating problems for smooth management of the office and assigning duties to the available staff especially during leave, deputation, training etc. Raising of tickets to TCS will not at all solve the issues | Correct Staff Scheduling System is required before CSI rollout and the names of all the employees in a Divisions need to be appeared under SSL in SAP |

19 | Wrong data entry in Employees Portal | Due to wrong data entries of DOB, DOE, DOR, Leave credits, the employees are not in a position to apply for leave through this portal. As experienced up to 80% data under this portal are found with incomplete / wrong entries. Most unfortunately, there is no provision for addition / alteration at Divisional / Circle level. Now it is solely controlled by TCS. | There should be a provision for modification / correction of wrong data in the software and it needs to decentralized to CO / DO level for arriving at instant solution. |

20 | Power to draw Cheques | Though as per rules, LSG postmasters and above are authorized to draw Cheques, the said provision is not available in the present software. | The vendor should provide such a facility. |

21 | Complex procedure for Cheque Requisition | More than 30 steps are to be followed for placing requisition of a single Cheque by the SPMs from the HO/GPO. When the number of Cheque Requisition will be more, the entire time of a single/double handed SPM will be spent of placing such requisition. | The procedure needs to be simplified minimizing the steps to be followed for the purpose. |

22 | Lengthy process for receiving / indenting stamp and cash | The procedure provided in the present software for indenting stamp and cash from HO, remittance of surplus cash to HO etc. is too lengthy and thus consuming more time than actually required. | The procedure needs to be simplified minimizing the steps to be followed for the purpose. |

23 | Use of unsuitable terminology | Different terminologies used for different heads of transactions / accounts in the present software do not suit to the postal operation and thus are not understandable. | Simple terminologies which will suit the postal operations need to be substituted in the software. |

24 | Unacceptable PIN Codes | At Point of Sale, PIN Codes of some offices are not accepted by the present software. Error message is displayed as the sender’s city name and PIN code are mismatched and there by not allowing to book the article under PoS . | The error needs to be addressed. |

25 | Synchronization of data | In CSI environment the synchronization of data is very essential for reflection of data in TCB and daily account. But all most on all the days since CSI rollout in Cuttack City Division, it is experienced that the daily sync and high sync are being failed continuously and hence the POS data and POS cash are not reflected properly in TCB. Sometimes the POS cash appears twice in TCB. Thus, difference in POS cash balance and Daily report or daily account balance has been a regular feature. | The issue needs to be addressed promptly. |

26 | CTS Cheque clearing & transit adjustment | No training has been imparted to the officials with respect to accounting of for the inward and outward CTS cheque clearings in CSI environment and transit adjustment. | The issue need to be addressed |

27 | Unusual concept of F & A | The F & A module of SAP is having a total different concept with double entry book keeping method using different T-Codes and posting every transaction in general ledger heads of 10 digit codes which is found to be tedious and time consuming action resulting more transaction time and inviting public resentment. | The process needs to be simplified to consume less time for effecting timely service delivery. |

28 | Pay Roll Data | At present, the data for payroll and HR particulars are prepared through an excel sheet since there is no exclusive provision in the CSI Software. Any error in preparation will lead to non-drawal of pay and allowances of the official(s). | There should be a provision to fetch payrolldata and HR particulars from Meghdoot package available at each HO/RO/CO/DAP instead of preparation through excel sheet as it is time consuming. |

(B SAMAL)

Circle Secretary

↧

UPU News : Visa to support financial inclusion programme

27.10.2017 - 20 by 2020: Technical Assistance Facility supports digitization of financial services offered through postal networks worldwide

The FITAF will advance financial inclusion by accelerating the digitization of postal financial services and increasing their uptake.

The Universal Postal Union (UPU) has recently established a Financial Inclusion Technical Assistance Facility (FITAF), which will receive significant support from Visa. As Stephen Kehoe, Head of Global Financial Inclusion at Visa Inc., explains, “Visa’s partnership with the UPU will make a significant contribution to financial inclusion. This systematic effort to leverage Posts’ services, size and reach will help build the comprehensive digital network needed to benefit whole societies, and especially help reach two priority groups of unbanked people: rural poor and women.” FITAF was created by the UPU to advance financial inclusion, by accelerating the digitization of postal financial services and increasing their uptake, to reach last-mile customers and businesses.

In order to increase the number of postal accounts by 250 million by 2020 and support the launch of digital financial service projects for financial inclusion from 20 Posts, FITAF will champion postal action on inclusive digital financial services, conduct research to identify key actions and provide qualifying Posts with technical assistance to improve and expand their capabilities. “This partnership is a key milestone in our efforts to position the postal network as a critical tool for delivering economic and social development to all,” emphasizes Bishar A. Hussein, UPU Director General. “Thanks to its universal coverage, to its long history as a financial actor and to the trust it holds amongst the citizens of the world, the postal sector is in a unique position to provide access to financial services to all and especially the underserved. We need to leverage that unique position.”

The situation

Over 2 billion adults worldwide were unbanked in 2014. Of those that are banked, 19% have an account at a Post, making the postal sector the second largest contributor to financial inclusion after banks. Postal networks are well positioned to meet the financial needs of some of the world’s hardest-to-reach populations. “Governments and international development stakeholders increasingly see the postal network, with its ability to deliver to everyone, everywhere and at all times, as critical infrastructure to achieving a whole range of public services and policies, including their financial inclusion objectives,” explains Siva Somasundram, UPU Director of Markets Development and Regulation.

Indeed Posts have extensive, government-backed networks that reach across countries into both urban and remote rural areas. They provide numerous services – including financial services – to customers of all income levels; they often distribute government payments, such as pensions or social support; and their public, egalitarian mission makes their services affordable and accessible to all segments of society. However, significant investment and transformation is required to improve postal capacities and services, so as to be able to deliver digital financial services and reap their many benefits.

The FITAF approach

FITAF will provide technical assistance to help Posts launch new digital financial services at a national level. Assistance will be offered according to need, based on requests from post offices, local levels of digital delivery, and the type of issue – such as product, network (e.g. back office) and systems (e.g. postal network, IT infrastructure). The criteria for selection include: commitment from the Post’s management and from government leaders; the existence of a legal and regulatory framework to enable the Post to deliver financial services; evidence of innovation; and willingness to co-fund 20% of costs. Support will also include designing mobile-based strategies for the Post, expanding Post-owned services, and capacity building.

The Facility carries out research to inform and advance Post-based financial inclusion. This includes developing case studies and best practices, identifying service and quality gaps, and creating a readiness guide to help Posts prepare to offer digital financial service. The Facility will also examine the role of Posts in supporting the financial inclusion of micro and small merchants near their branches. A crucial aspect of this work is sharing new insights and resources with UPU members and other stakeholders through regional and leadership meetings, as well as at partner events. For example, UPU organized four regional workshops for members in 2017 to explain the importance of digitization and to present effective business models and services.

Partner coordination

Visa joins the Bill & Melinda Gates Foundation and the UPU in funding the Financial Inclusion Technical Assistance Facility. Visa will provide financial support for three years through a charitable grant. The UPU has collaborated with a number of Visa’s global financial inclusion partners, including the Alliance for Financial Inclusion and Better than Cash Alliance, which the UPU joined in 2015. It has also issued joint research publications on financial inclusion with the World Bank, UN Women and the International Labor Organization, and collaborated with diverse service providers at the country level – policy makers, academics and social-welfare organizations. This inter-connectedness exemplifies the type of collaborative, coordinated approaches needed to achieve financial inclusion.

For more information on financial inclusion:

↧

UPU International Bureau achieves climate neutral status

02.11.2017 - Recognizing that our operations have an impact on the environment, the UPU regularly measures and takes action to reduce the carbon footprint of its secretariat, the International Bureau.

The 2016 environmental inventory, performed in collaboration with Sustainable United Nations (SUN), shows that direct greenhouse gas emissions from the International Bureau have decreased by 10% since 2014. In addition, the UPU has chosen to offset all emissions, earning the International Bureau climate neutral status for 2016.

These positive results are a reflection of the UPU's commitment to sustainability and its efforts to implement greener approaches to managing our activities, resources and facilities.

In 2016, the UPU generated a total of 983 tonnes of carbon dioxide equivalent (tCO2eq) as a direct result of International Bureau activities. Of that amount, 29% originated from our facilities, 69% were related to air travel, and 2% to other forms of transport. Emissions per staff member total 3.78 tCO2eq, compared with the UN average of 7.18 tCO2eq.

UPU climate data has been published today in the UN-wide sustainability report: Greening the Blue Report 2017. The report details the greenhouse gas emissions produced in 2016 by the UN system as a whole, as well as each UN entity individually.

The UN has committed to becoming climate neutral across all entities by 2020. The data published in the Greening the Blue Report reveals that the 67 UN entities that reported their greenhouse gas emissions collectively emitted a total of 1.90 million tCO2eq in 2016, and 37% of these emissions were offset.

Earlier this year, in a speech on climate action, UN Secretary General António Guterres highlighted the importance of working together to combat climate change: "All of us – governments, businesses, consumers – will have to make changes. More than that, we will have to be the change. This may not be easy at times. But for the sake of today's and future generations, it is the path we must pursue."

SUN project coordinator, Isabella Marras, has commended the progress made by entities in the 10 years since the UN Chief Executive Board approved the UN's Climate Neutral Strategy in 2007: "The leadership and dedication shown by UN staff at all levels has been inspiring. We've seen efforts to measure and reduce our environmental impacts across all agencies, in all countries, via numerous activities, and I'm confident that the UN is on track to meet the goal of being climate neutral, through emissions reductions and offsetting, by 2020."

Efforts to reduce greenhouse gas emissions and improve overall environmental performance have continued across the UN throughout 2017, with several entities adopting a systematic approach to reducing their environmental footprint. For more information on the methodology used, please visit Greening the Blue.

More information about the UPU's environmental efforts

The UPU works together with SUN to measure and manage the environmental impact of the International Bureau. In addition, the UPU supports its worldwide network of postal operators in their efforts to address their climate impact through the free online tool OSCAR – the Online Solution for Carbon Analysis and Reporting (https://oscar.post).

↧

↧

Happy Kartik Poornima

↧

Extraordinary General Body Meeting of the Divisional Union on 05.11.2017

↧

Meet the mailman who delivered 'good news' during World War II

Loyd Leatherman was 18 years old when he first stepped aboard the U.S.S. Oglethorpe, the massive Navy cargo ship that would be his home for the next two years. It was 1944, the world was at war and Leatherman had just finished his training in San Francisco. He was preparing for life thousands of miles away in the Pacific when his captain approached him.

“He said, ‘You’re going to be the first man over the side when we hit port and you’re going to be the last man to board when we leave. And that’s just the way it’s going to be,'" Leatherman, now 90, told ABC News.

Leatherman's mission was one that was crucial to morale, his captain explained.

"He said, ‘I want you to understand, from my point of view, the mail is the most important thing on this ship,’” Leatherman said. “We delivered the good news, basically."

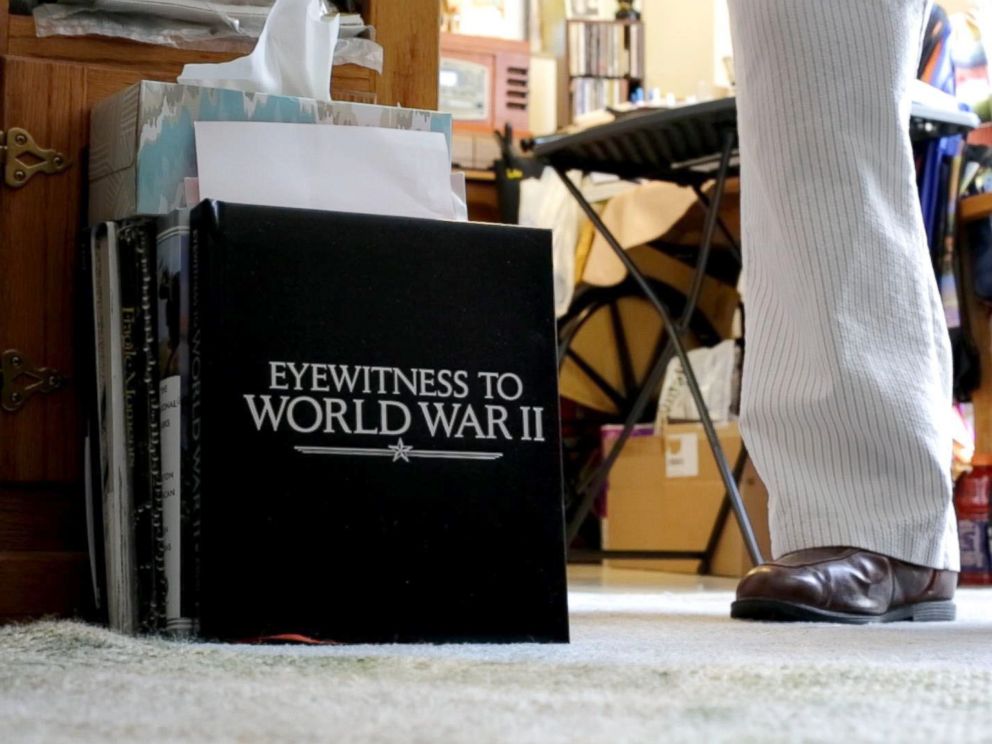

Janet Weinstein/ABC News :

A photo of Loyd Leatherman during his WWII military service as a mailman. He was 19-years-old.

Leatherman said that once the U.S.S. Oglethorpe set sail, the captain's words rang true: loaded down with about five bags of mail, he said he was the first person off the ship when it docked and the last person to board when it left port. He carried letters from soldiers to their loved ones at home to the port's post office, and picked up mail for sailors on his way back. Sometimes his journey included riding in the back of a jeep, other times he would have to trek by foot. He said he was almost always accompanied by armed escorts.

“Every time I got back to the ship with all this mail, they could hardly wait for me to get it sorted and get it out to them,” Leatherman said.

According to the Post Office Department's 1945 Annual Report, more than 56,000 postal personnel like Leatherman served in the U.S. armed forces during World War II. They worked, lived and died alongside the U.S. soldiers deployed across the world. Their mission was one that, while not always mentioned in history books, was crucial to the war effort.

Janet Weinstein/ABC News

Mail was often the only lifeline troops stationed far away had to their loved ones back home, Leatherman said.

"The physicality of the mail itself –- the smell, touch, handwriting –- were reminders of people and relationships, while the sentiments and ideas expressed were reminders of values and priorities in life," Lynn Heidelbaugh, a curator at the Smithsonian's National Postal Museum, told ABC News.

"Mail had the power to shape morale by providing a connection to oneself, to people one valued, and to one’s community," Heidelbaugh added.

Leatherman said he delivered many magazines to troops stationed around the Pacific Theater. He also remembers picking up money orders bound for their families back in the U.S.

Janet Weinstein/ABC News

Most of the pieces of mail he handled, however, were handwritten letters to loved ones at home.

“Dear folks, today I received two letters from you and I was mighty pleased to get them,” Leatherman himself wrote to his parents in 1946. He still has that letter in his home.

Leatherman was assigned to the ship after the war ended for wrap-up efforts, he said.

“After we get all unloaded, we’re supposed to be available for troops and cargo on the return trip. I figure it will take four months, so I should be eligible for discharge when I’m back,” he wrote to his parents at the time.

Janet Weinstein/ABC News

Though as a mailman he never fought in battle, Leatherman said there were times that the job could be dangerous. As he was walking on the main deck of the ship with a friend, he said a Japanese spy plane flew out from behind the clouds and shot and killed the man right beside him.

“He got a bullet in his heart and his heart exploded. He was dead before he hit the deck. And I never got a scratch,” Leatherman said.

“Unfortunately, I don’t remember his name,” he added. “A lot of the guys, I can’t remember their names after this time.”

Janet Weinstein/ABC News

Today, Leatherman lives in a small apartment in Denver, Colorado. He said he was married once, to a woman named Betty, for more than 25 years. She died in 1978 of a heart attack. They had two kids, both grown now, and he never remarried.

Surrounding him in his cluttered back room are scrapbooks and photo albums from his near-century-long life. One book has a dozen or so pictures that he took aboard the U.S.S. Oglethorpe. The book also contains some of the letters he wrote to his parents while at sea and the original arm patch he wore on his uniform.

It’s been more than 70 years since Leatherman was aboard the U.S.S. Oglethorpe, but “I couldn’t have asked for a better duty,” he said of his time there.

Leatherman said he tried to get involved in the postal service when he was discharged, but his small town of Rand, Colorado, wasn’t hiring at the time. He said he ended up getting involved in a family friend's business selling jewelry. While he loved his job, he said he missed delivering the mail.

When asked if he could ever foresee something like World War II happening again, Leatherman grew solemn.

“In World War II, we had to stop the Nazis cold,” he said. “And we had to stop the Japanese cold. We just had to stop it completely. And if we hadn’t done that, nobody would have any rights at all today.”

“Too many people running around in this country don’t even think about those things," he added. "They don’t even realize how lucky they are.”

Source : http://abcnews.go.com/

↧

Extraordinary General Body Meeting of AIPEU, Gr-C, Bhubaneswar Division conducted successfully on 05.11.2017

↧

↧

EXTENSION OF TIME PERIOD FOR SUBMISSION OF PREFERENCE FORM

↧

GRANT OF DEARNESS RELIEF(DR) TO THE PENSIONERS/FAMILY PENSIONERS OF CENTRAL AUTONOMOUS BODIES WHICH ARE IN RECEIPT OF PENSIONS IN PRE-REVISED PAY STRUCTURE /SCALE OF 6th CPC.

↧

GDS COURT CASE --- AN UPDATE

IT IS INFORMED THAT THE COURT PROCEEDINGS OF GDS CASE IN PR CAT, DELHI IS FURTHER ADJOURNED TO 12TH FEBRUARY 2018.

↧